In the competitive landscape of e-commerce, a seamless and swift checkout process is paramount to converting Browse visitors into loyal customers. Cart abandonment remains a significant challenge for online retailers, often attributed to lengthy or complicated checkout flows. WooCommerce express checkout plugins offer a powerful solution, streamlining the purchasing journey and significantly improving conversion rates. This article explores the benefits and key features of these essential tools.

What is Express Checkout?

Express checkout streamlines the online purchasing journey by reducing the steps and data entry required to complete a transaction. By utilizing stored customer information or integrating with digital wallets, it allows shoppers to place orders quickly and effortlessly. The speed and ease provided by WooCommerce Express Checkout Plugins significantly enhance user experience, reduce cart abandonment, and increase conversion rates—making them essential tools for modern eCommerce stores.

The Challenge of Cart Abandonment

Cart abandonment remains a major challenge in e-commerce, often caused by lengthy forms, surprise fees, or an untrustworthy interface. A complicated or slow checkout process is one of the leading reasons shoppers leave without buying. Implementing WooCommerce Express Checkout Plugins helps eliminate these hurdles by offering a faster, simplified experience—reducing friction, building trust, and ultimately boosting conversion rates and revenue for your online store.

Fast Checkout for WooCommerce

Fast Checkout for WooCommerce delivers a seamless user experience by placing a one-click checkout button directly on product and cart pages. Its flexible configuration enables direct integration with payment gateways, eliminating unnecessary steps and accelerating the purchasing process. As one of the top WooCommerce Express Checkout Plugins, it helps reduce cart abandonment, improve user flow, and increase conversions by making the checkout journey faster and more efficient.

Key Features of Effective Express Checkout Plugins

A robust express checkout plugin offers a range of features designed to optimize the buying process. These functionalities aim to reduce friction and enhance user satisfaction.

- One-Click Purchase: Enables registered users to buy products with a single click, using pre-saved payment and shipping information.

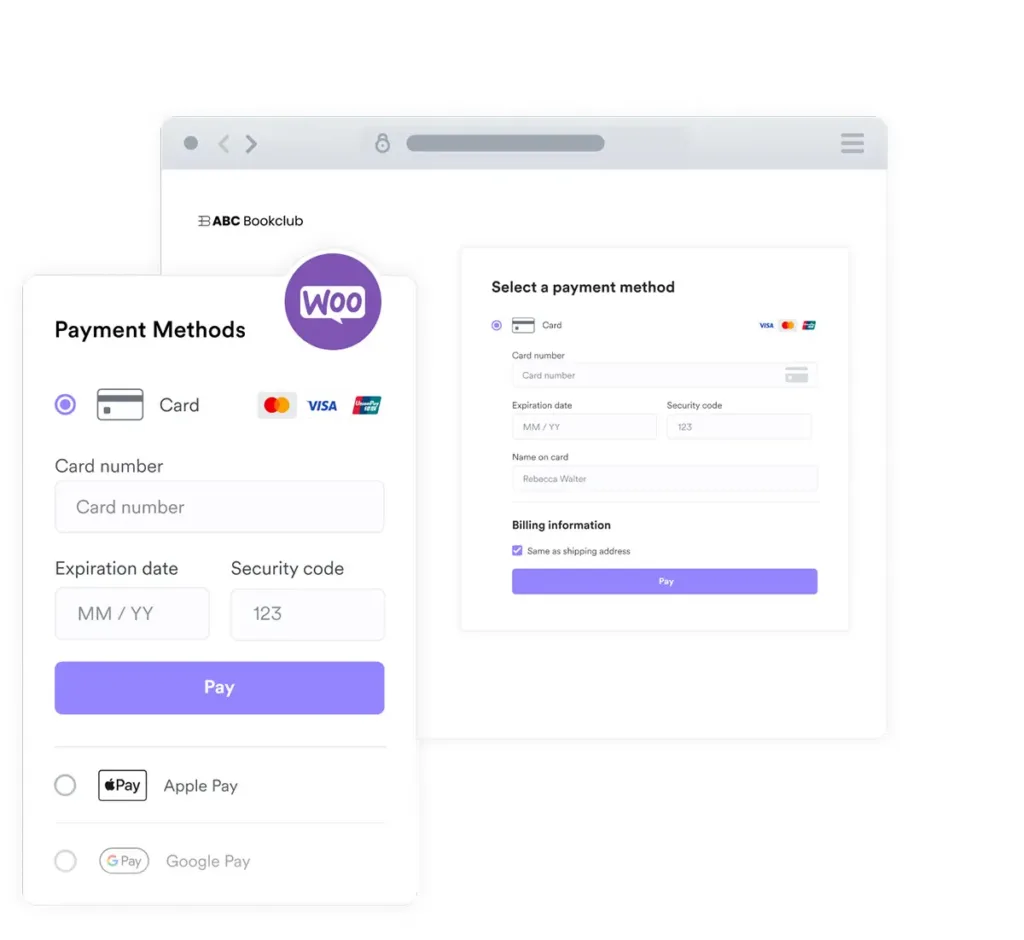

- Integration with Digital Wallets: Supports popular options like Apple Pay, Google Pay, and PayPal Express for faster, secure payments.

- Customizable Checkout Fields: Allows store owners to add, remove, or reorder fields to create a more concise and relevant form.

- Mobile Responsiveness: Ensures a smooth and intuitive checkout experience across all devices, particularly on smartphones and tablets.

- Direct Checkout from Product Pages: Bypasses the cart page, sending customers directly to checkout for immediate purchase.

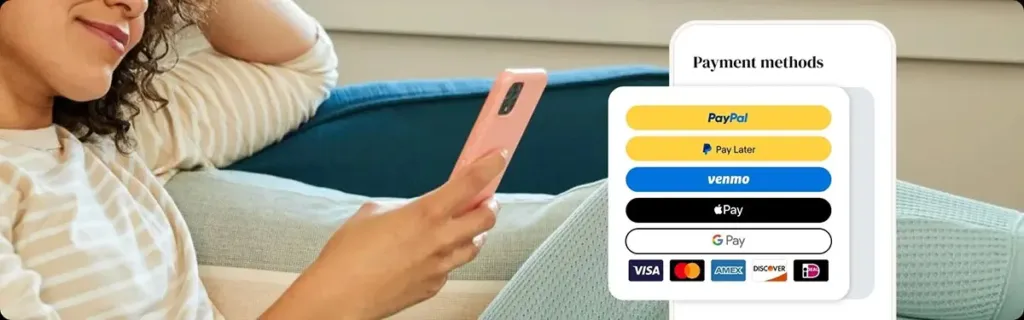

PayPal Payments for WooCommerce

PayPal is a trusted name in the world of digital payments, known for its global reach and strong reputation for security. Integrating PayPal into your online store leverages its brand power to boost customer trust and encourage purchases. Shoppers are more likely to complete their transactions when they see a familiar and reliable payment option, reducing cart abandonment and increasing conversion rates.

One standout feature is PayPal’s all-in-one checkout solution, which allows merchants to offer a range of payment methods—including PayPal, Pay Later, credit/debit cards, and local options—within a single, seamless interface. This flexibility enhances the checkout experience and meets diverse customer preferences.

Incorporating PayPal doesn’t just streamline payments—it also adds value by simplifying backend processes like refunds, reporting, and fraud protection. Its built-in tools help businesses manage transactions efficiently while maintaining peace of mind. Whether you’re a small business or an established eCommerce brand, PayPal’s solutions make it easier to deliver a fast, secure, and customer-friendly checkout experience.

WooPayments

WooPayments is WooCommerce’s native payment solution, designed to simplify online transactions for store owners by providing seamless integration within the WooCommerce ecosystem. It handles payments, payouts, and security with minimal setup—everything stays inside your WordPress dashboard.

One standout feature of WooPayments is its real-time sales and financial dashboard, which provides instant insights into payments processed, revenue status, and payout schedules. This centralized analytics view helps merchants monitor transactions efficiently, reconcile accounts easily, and understand cash flow right from their WooCommerce admin area.

WooPayments ensures secure, PCI-compliant payment processing by leveraging Stripe’s infrastructure under the hood. With automatic fraud protection, transparent flat-rate pricing, and support for global currencies, it empowers store owners to accept credit cards, local payment methods, and recurring subscriptions with confidence and ease.

Amazon Pay

Amazon Pay is a fast, secure, and trusted payment solution that allows customers to use their Amazon credentials to make purchases on third-party websites. It leverages the familiarity and security of the Amazon ecosystem, making the checkout process smoother and more reliable for both merchants and buyers.

A notable feature of Amazon Pay is its Alexa integration, which enables voice-assisted transactions. This lets users make purchases, manage payments, or check order statuses using Alexa-enabled devices, adding convenience and a modern touch to the shopping experience.

With built-in fraud protection, mobile optimization, and access to millions of Amazon customers, Amazon Pay helps boost conversion rates and customer trust. It’s an ideal solution for businesses looking to offer a quick and user-friendly checkout option.

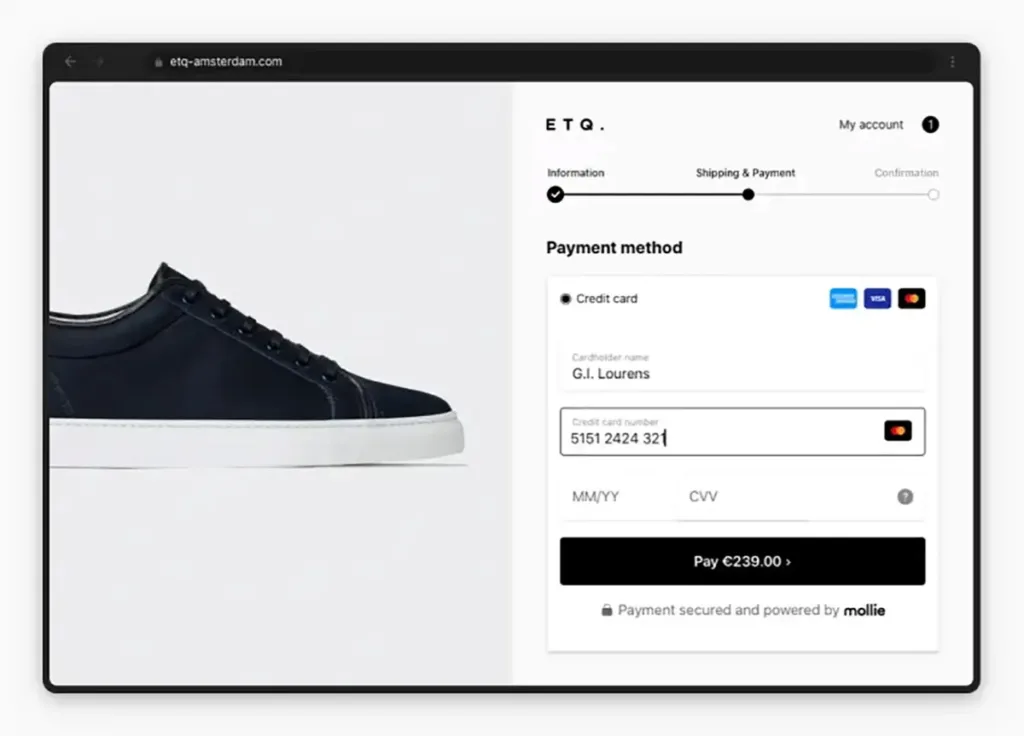

Mollie Payments

Mollie Payments is a flexible and developer-friendly payment gateway designed to help businesses of all sizes accept online payments with ease. It supports a wide range of payment methods, including major credit cards, PayPal, Apple Pay, and regional options like iDEAL and Bancontact.

One standout feature of Mollie is its pre-built hosted checkout, which allows businesses to accept payments without handling sensitive data directly. This secure and optimized checkout page ensures compliance, reduces fraud risk, and enhances user trust—all while providing a seamless experience across devices.

With easy API integration, transparent pricing, and fast onboarding, Mollie is well-suited for startups, eCommerce platforms, and international merchants seeking simplicity, scalability, and a reliable payment infrastructure.

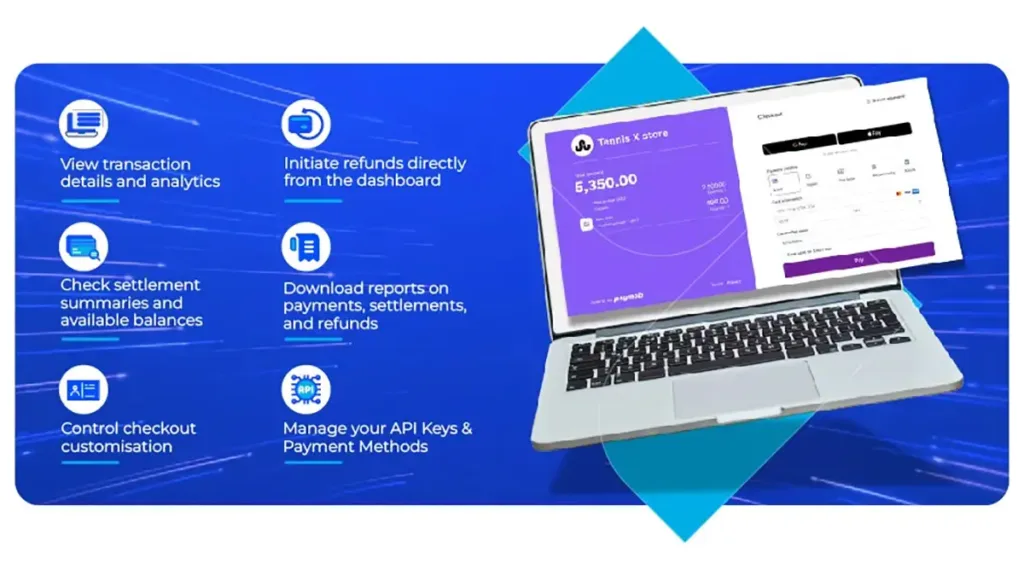

Paymob Checkout

Paymob Checkout is a powerful payment solution designed to streamline the online payment experience for businesses of all sizes. It allows merchants to accept various payment methods, including cards, mobile wallets, and local payment options, making it versatile and accessible. With its simple integration and user-friendly interface, businesses can quickly set up and start transacting securely.

One standout feature of Paymob Checkout is its Smart Routing, which automatically chooses the most efficient transaction path to maximize success rates and minimize processing fees. This not only improves customer satisfaction by reducing failed payments but also optimizes profitability for merchants.

Overall, Paymob Checkout combines speed, security, and flexibility into a single platform, helping businesses enhance conversion rates and build trust with their customers.

Airwallex Payments

Airwallex Payments is a modern global payment platform designed to help businesses expand internationally with ease. It enables seamless cross-border transactions, supporting multiple currencies and local payment methods without the need for traditional banking infrastructure. This makes it an ideal solution for startups, eCommerce, and enterprise-level companies aiming to scale globally.

A key feature of Airwallex Payments is its multi-currency virtual accounts, which allow businesses to receive payments in local currencies without forced conversion. This reduces foreign exchange costs and provides more control over international revenue. The platform also offers transparent pricing and real-time exchange rates.

With its powerful APIs, secure infrastructure, and broad international reach, Airwallex empowers businesses to grow faster by simplifying and optimizing their global payment operations.

Billie

Billie is a payment solution designed to simplify B2B transactions by offering flexible and risk-free payment options. It empowers merchants to offer business customers the ability to buy now and pay later without added complexity. This boosts conversion rates and helps foster long-term client relationships.

A standout feature of Billie is its Buy Now, Pay Later (BNPL) for B2B service. This allows business customers to purchase goods immediately while deferring payments, giving them greater cash flow flexibility. Billie also manages credit risk and dunning, enabling merchants to get paid upfront while Billie takes on the payment responsibility.

With a focus on automation and seamless integration, Billie offers API support and plug-ins for e-commerce platforms. It’s particularly suited for B2B sellers looking to modernize their checkout process.

Conclusion

In conclusion, WooCommerce Express Checkout Plugins are crucial for streamlining your store’s sales funnel and enhancing the customer experience. By enabling a faster, simplified checkout process, these plugins reduce friction, lower cart abandonment rates, and boost conversions. Whether opting for a free solution like PeachPay or a premium tool like One Page Checkout, integrating express checkout can lead to significant improvements in both user satisfaction and revenue growth.